I have a question for you: When was the last time you scrolled through social media without feeling the temptation to shop?

It’s not just the obvious ads that come across your feed – although those may be the first ones that come to mind – it’s also the posts that subtly push a specific product or brand.

For Gen Z – those of us born between 1997 and 2012 – this virtual environment helps to fuel a growing culture of impulsive spending. Between the vendors that allow you to ‘buy now, pay later,’ and the rise of influencers, it’s easy to feel overwhelmed by the constant stream of trends, tech, and must-have experiences, that supposedly contribute to one’s best life. I know firsthand what it’s like to hit the purchase button even when my finances are telling me not to. In those moments, I tell myself: ‘But, I need these (fill in the blanks), even though I know I’ll never use them again’ or ‘I’ve seen a lot of my peers use this water bottle so it must be great – even though it costs half my car payment!’

Despite these red flags, I sometimes still opt for temporary satisfaction.

As a young consumer, I want to do better so I reached out to Stephanie Martin, a Financial Wellness Coach for Greylock’s Community Empowerment Center. We talked about strategies to help minimize these temptations.

Here are a few takeaways from our conversation:

Pause before you tap - just because the ad came up doesn’t mean you need to do anything with it.

Remove your payment info from online retailers. Making it harder to check out gives you more time to reconsider your purchases – and reduces the ease of emotional spending.

Be cautious around using ‘Buy Now, Pay Later’ services that encourage you to purchase items online and pay for them in installments. These apps may seem convenient, but they can lead to harsh impacts on your credit score, overextending your budget, and encourage cycles of debt.

Ask yourself, “Is it going to benefit me after today?” If the answer is no, you may want to think twice about the purchase.

Separate your money into different accounts; differentiating bill money and shopping money helps prevent overspending and will likely keep you on track.

Prioritize your expenses. Ask yourself these questions: What matters to you? What makes this a need, rather than a want? What will this do for me?

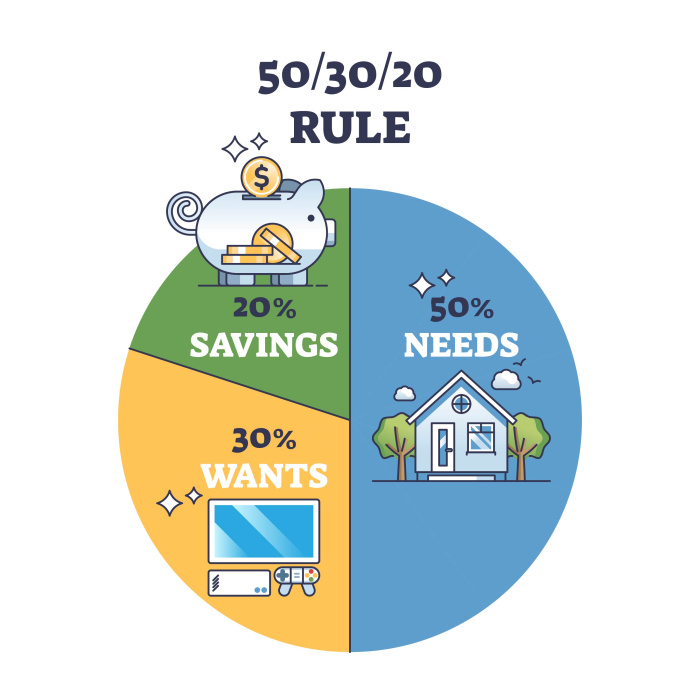

Martin, who has been a Financial Wellness Coach for nearly seven years, emphasizes that the line between needs and wants varies for everyone – and that’s okay. Still, she advises that 50 percent of your money should go to needs, 30 percent into wants, and 20 percent into savings. “Savings is a huge component of becoming a responsible adult,” she notes.

Shortly after our conversation, I went home and took my default payment methods out of all my usual online shopping sites. And while I didn’t expect it to magically transform my financial wellness overnight, I do think it’s a great step in the right direction. So far it’s proven to be successful! I haven’t bought anything online since, and it’s made me realize that the ease of impulse buying has been a bigger hit to my savings than I thought.

Retail therapy is fun. We all like new, shiny things, but in an environment where spending is just a swipe away, taking back control of your financial decisions is more than just good decision making – it’s empowering.

Written by Sara Stevens, Marketing Intern